Which Of The Following Is The Most Frequently Used Tool The Fed Uses To Control The Supply Of Money?

"The Federal Reserve sets two overnight interest rates: the interest rate paid on banks' reserve balances and the rate on our reverse repurchase agreements. We use these two administered rates to keep a market place--determined rate, the federal funds rate, within a target range ready by the FOMC."

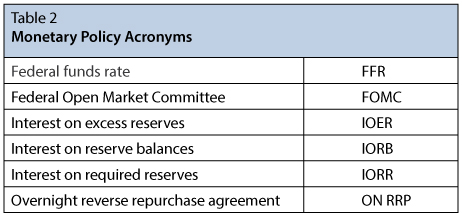

—Jerome Powell, Chair of the Federal Reservei

Description

The Federal Reserve (the Fed) and its monetary policy tools have a significant presence in economics standards, textbooks, and curricula. The Fed has changed the way information technology implements monetary policy, just many of the recent changes are not reflected in teaching resources. This special event of Page One Economics ® is intended to provide data and teaching guidance for educators as they transition to teaching nearly the new tools of budgetary policy.

Introduction

The Federal Reserve, the central bank of the U.s.a., has a Congressional mandate to promote maximum employment and price stability. While those goals were articulated in 1977,2 the approach and tools used to implement those objectives have inverse over fourth dimension. Before the Financial Crunch of 2007-09, the Fed implemented budgetary policy with limited reserves in the banking system and relied on open up marketplace operations as its key tool. Today, the Fed implements monetary policy with aplenty reserves and relies on 1 of its administered rates. Interest on reserve balances (IORB), with the associated IORB rate, is the primary tool.three These changes might seem subtle, but the current framework is very unlike from the previous one. This article provides an overview of how policy has changed, with useful distinctions and guidance for anyone who teaches about the Federal Reserve and budgetary policy.

Teaching Monetary Policy

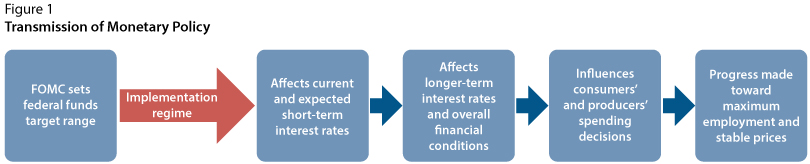

The Federal Open Market Commission (FOMC) of the Federal Reserve sets the stance (position) of monetary policy to guide employment and prices (inflation) in the desired direction. Effigy one shows the chain reaction of how the opinion of monetary policy is transmitted through financial markets and ultimately affects economy activeness. This article focuses on the alter in the choice of the level of reserves to supply to the banking system and the monetary policy tools used before and after 2008 that affect the kickoff link in the chain: that is, how the Fed ensures that when the FOMC sets a particular federal funds target range (Box 1 in Figure ane) that this level is also reflected in current and expected short-term interest rates (Box 2). Within the Fed, this modify in tools reflects a change in what they call their "implementation regime." Here we volition talk nigh information technology as a change in the Fed's policy implementation framework.

The FOMC's policy stance is transmitted through financial markets to affect consumers' and producers' spending decisions, which ulti mately moves the economy toward the Fed's objectives—maximum employment and stable prices. This monetary policy implementation framework ensures that when the FOMC changes its policy stance (raises or lowers the federal funds [FFR] target range), financial markets move in the desired direction.

As Figure 1 shows, current and expected brusk-term involvement rates influence long-term interest rates and overall financial conditions (Box three). Those rates and conditions so influence consumers' and producers' spending decisions (Box iv)—whether they spend coin or relieve money. Those spending decisions then affect overall spending, investment, and production, which affect employment and aggrandizement (prices).

For the public, the manner the Fed implements policy is generally non evident in their everyday lives. FOMC policy actions, however, are designed to steer the economy toward maximum employment and stable prices. Considering monetary policy affects the economy, the way it is implemented is important to include in textbooks, standards, and curricula. And because policy can and has changed faster than these materials are updated, it is important for educators to understand the changes and accommodate their instruction to explicate them.

An Overview of the Old Framework: Monetary Policy with Limited Reserves

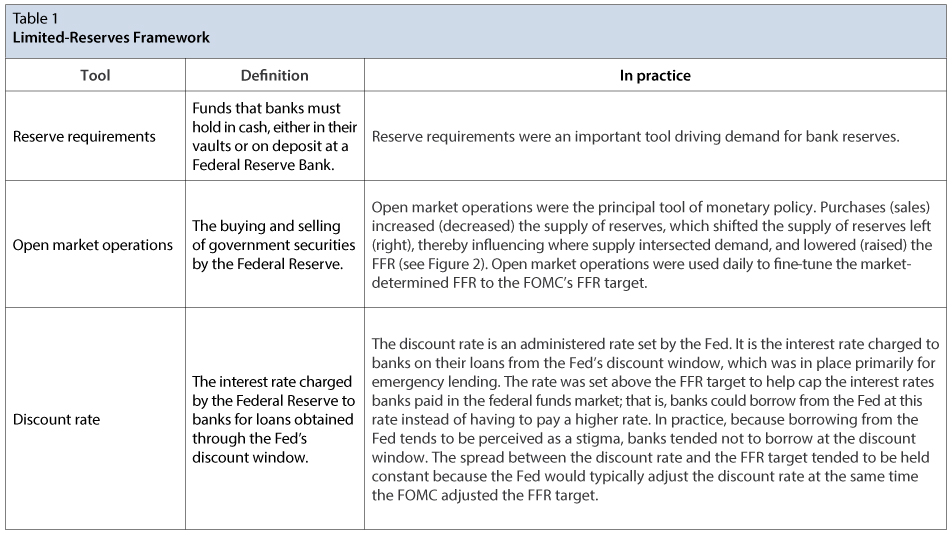

Prior to 2008, the Fed used a framework in which it supplied a limited amount of reserves to the banking system. Traditionally, total bank reserves are composed of two types: (i) Required reserves are funds that a depository establishment must hold in reserve confronting specified deposits as vault greenbacks or deposits with Federal Reserve Banks. (ii) Excess reservesouth are funds that a depository institution holds in its account at a Federal Reserve Bank in excess of its required reserves balance.

Banks held reserves to meet the Fed's regulatory reserve requirements and to ensure they had acceptable funds to run across the banking demands of their customers. Considering reserves earned no interest, banks tended to hold just a bit more what was needed to meet their reserve requirements. When banks needed actress reserves to encounter their demands, they would borrow reserves in the federal funds market. Or, if banks had excess reserves, they could lend them in the federal funds market. In terms of market place participation, banks that lent coin acted as suppliers of reserves in the federal funds market place, and banks that borrowed money acted every bit demanders of reserves in the federal funds market. This interaction betwixt supply and demand adamant the federal funds rate (FFR), which textbooks define every bit the interest rate that banks charge each other to borrow or lend reserves in the federal funds market.4

Chiefly, the FFR is the policy charge per unit that the FOMC uses to set up the stance of budgetary policy in pursuit of its objectives. More than specifically, the Fed sets a target for the FFR and so uses monetary policy tools (explained below) to influence the market-determined FFR to move toward the FFR target. That is, the Fed uses its tools to influence the involvement rate that banks charge each other in the federal funds marketplace to move toward the FFR target.

In the limited-reserves framework, the Federal Reserve sells or buys U.Southward. Treasury securities in the open marketplace to shift the supply of reserves left (right), which moves the FFR higher (lower). Relatively small-scale movements of the supply curve motion the FFR.

Figure 2 depicts the money market place diagram that may be familiar to teachers and professors. The diagram captures the relationship between reserves and the FFR.five The downwardly-sloping demand bend represents banks' demand for reserves. The top of the curve is capped by the Fed'south discount rate, which acts similar a ceiling for the FFR because banks would be unlikely to infringe funds at a higher rate than they could get at the Fed'due south discount window. The demand bend slopes downwardly to capture the idea that equally the cost of borrowing decreases, banks are willing to borrow more funds to increase their holdings of reserves. The supply curve is vertical considering only the Fed tin can supply reserves. The intersection of the two lines determines the FFR.

When reserves are limited (or scarce), relatively minor increases or decreases in the supply of reserves shift the supply bend right (left) and upshot in a lower (higher) FFR as follows:

- To heighten the FFR, the Fed decreases the supply of reserves by selling U.S. Treasury securities in the open market.half dozen The decrease in reserves shifts the supply curve left, resulting in a higher FFR.

- To lower the FFR, the Fed increases the supply of reserves by ownership U.South. Treasury securities in the open up market. The increment in reserves shifts the supply curve right, resulting in a lower FFR.

The Fed's buying and selling of U.S. Treasury securities is referred to equally open market place operations, and it was the primary tool the Fed used to arrange the FFR and movement the economy toward maximum employment and stable prices prior to 2008. In this framework, the Fed tended to use daily open up market place operations to fine-melody the location of the supply curve and keep the FFR at the FOMC's target. The Fed tended to keep the spread betwixt the discount rate and FFR roughly constant. So, when the FOMC raised or lowered its policy target, the Fed besides raised or lowered the discount charge per unit.

In summary, prior to 2008, monetary policy focused on influencing the supply of reserves in the banking system (using daily open market operations) equally a ways for adjusting the FFR. Table 1 notes how textbooks and curricula take usually described monetary policy in a limited-reserves framework and also notes how it worked in practice before 2008.

How the Financial Crisis Changed Monetary Policy

In response to economical and fiscal atmospheric condition in 2008, the Federal Reserve lowered the FFR target to near zero. And, it as well shifted from setting a unmarried FFR target to setting a FFR target range, with the upper and lower limits of the range consistently 0.25 percentage points apart. For example, starting in December 2008, the target range was set at 0 to 25 basis points (i.e., 0.0 to 0.25 percentage). But even with that low range, the economy still needed more stimulus.7 Every bit a result, between 2008 and 2014 the Fed conducted a series of big-scale asset-purchase programs to lower longer-term interest rates, ease broader financial market conditions, and thus support economic activity and job creation.8 In particular, the Fed purchased a sizable amount of longer-term securities issued by the U.South. government and issued or guaranteed past regime-sponsored agencies such as Fannie Mae and Freddie Mac. These purchases non only increased the Fed's level of securities holdings but also increased the total level of reserves in the cyberbanking arrangement from around $15 billion in 2007 to about $ii.seven trillion in late 2014. At this signal, reserves were no longer limited but instead quite plentiful, or "aplenty."

The Financial Crunch also resulted in the implementation of new monetary policy tools. The nearly significant was interest on reserve balances (IORB). Congress had given the Fed authority to pay IORB in 2006, with a outset appointment of 2011. The offset engagement was pushed up to October 2008 so the Fed could use the tool during the Fiscal Crunch.

IORB applies to both required reserves (IORR) and backlog reserves (IOER).

- IORR: Prior to the Financial Crisis, when banks held their required reserves on deposit at Federal Reserve Banks they received no interest bounty, which they recognized equally a lost opportunity to earn interest elsewhere. For this reason, it was seen every bit regulation that imposed an "implicit taxation" on banks. IORR eliminated the implicit tax on reserve requirements.

- IOER: Because banks did non receive interest on their reserves held at the Fed, banks frequently minimized their holdings of excess reserves. The Fed's decision to start paying IOER changed the incentives for the marginal excess dollar in reserves. The IOER charge per unit became a tool to influence banks to hold more or fewer backlog reserves. For example, a higher IOER charge per unit relative to market place (alternative) interest rates increased the incentive for banks to hold excess reserves at the Fed. Equally such, IOER gave the Fed a powerful new tool for implementing budgetary policy.

From October 2008 to March 2020, IORR and IOER were gear up to the aforementioned rate. Then, effective March 26, 2020, the Board of Governors of the Federal Reserve Organization announced that information technology was reducing reserve requirements to zero, making IORR finer irrelevant.9 Finally, as of July 29, 2021, the Federal Reserve eliminated references to an IORR rate and to an IOER rate and replaced them with a single IORB rate.

As the economic system recovered from the Great Recession, the Fed took steps to reduce the supply of reserves from its peak in October 2014 of about $2.7 trillion. Over the side by side few years, the Fed reduced reserves to well-nigh $ane.7 trillion. They notwithstanding remained ample, however. In fact, in January 2019, the FOMC released a argument proverb it would continue to implement policy with aplenty reserves in the long run.10,eleven

The New Framework: Budgetary Policy with Ample Reserves

When there is a large quantity of reserves in the banking organisation, the Federal Reserve tin no longer influence the FFR by making relatively small changes in the supply of reserves (Figure three). That is, because the supply bend intersects the apartment (horizontal) portion of the demand curve, pocket-size shifts in the supply curve to the correct or left will non move the FFR higher or lower. Rather, in the ample-reserves framework, the Fed uses its administered rates, which include the IORB rate and the overnight reverse repurchase agreement (ON RRP) rate, to influence the FFR. This section describes how this new framework works.

In the aplenty-reserves framework, the Federal Reserve raises (low ers) its administered rates to move the FFR college (lower). Pocket-sized shifts of the supply curve have niggling or no effect on the FFR charge per unit.

Figure 3 shows the need and supply curves in the current aplenty-reserves framework. The summit of the need curve is still influenced by the Fed'south disbelieve charge per unit. Now, however, the demand curve turns flat almost the Fed's new administered rates, which helps steer the FFR into the FOMC'south target range. The supply curve is such that information technology intersects the need curve where it is flat. With this "aplenty" level of reserves, the Fed does non need to make daily open market operations to purchase or sell securities, equally it did in the limited-reserves framework to striking the FFR target (because now small shifts of the supply bend take little or no effect on the FFR rate).

Banks seek to earn a return on their money, and they have several options. I is to deposit backlog cash at their Federal Reserve Bank (reserve balances) and earn interest. Another pick is to lend the backlog cash out in the federal funds market and earn the agreed-upon FFR. A third pick is to invest the greenbacks in Treasury bills and earn the given Treasury bill charge per unit.

The principal tool for keeping the FFR in its target range and driving the demand curve apartment is the IORB rate. Although banks have several short-term investment options for their coin (Figure four), the IORB rate offers them a safe overnight option. Because IORB makes cash deposited at the Fed a risk-gratis investment selection, banks are unlikely to lend reserves in the federal funds market for less than the IORB rate. In other words, the IORB rate serves as a reservation charge per unit for banks—the everyman rate that banks are probable willing to accept for lending out their funds. And, if the FFR were to autumn very far beneath the IORB charge per unit, banks would be likely to borrow in the federal funds market and eolith those reserves at the Fed, earning a profit on the difference. This is known as arbitrage, an important aspect of the style financial markets, and budgetary policy, work. Arbitrage ensures that the FFR does non autumn much beneath the IORB charge per unit.

These financial incentives (i.east., the reservation rate and arbitrage) are such that when the Fed raises or lowers the IORB rate, the FFR also moves up or down. Equally such, the Federal Reserve tin can steer the FFR into the target range set by the FOMC by adjusting the IORB rate.12 And, because the Fed sets the IORB rate straight, IORB serves as an effective monetary policy tool. Currently, IORB is the pri mary tool used past the Fed for influencing the FFR.

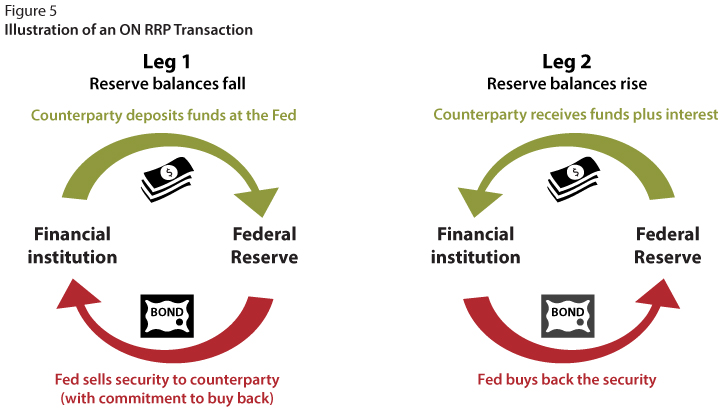

However, not all institutions with reserve accounts can earn involvement on their deposits at the Federal Reserve and non all important institutions in financial markets are allowed to have an account at the Fed. This leaves the possibility that of import brusk-term rates (including the FFR) might drop beneath the IORB charge per unit. So, in 2014, the FOMC announced that it intended to use the ON RRP facility to assist control the FFR.thirteen The ON RRP facility is a form of open market place operations where the Fed stands ready to interact with many nonbank financial institutions, such as large coin market funds and authorities-sponsored enterprises.xiv When 1 of these institutions uses the ON RRP facility, information technology essentially deposits reserves at the Fed overnight, receiving a security as collateral. The next day the transaction is "unwound"—the Fed buys back the security and the institution earns the ON RRP charge per unit (which the Fed sets) on the cash information technology deposited at the Fedxv (Effigy 5).

When using the Fed's ON RRP facility, the counterparty interacts with the Fed in ii steps. Kickoff, today (Leg 1) the counterparty deposits funds at the Fed. Second, considering this is an ON (overnight) RRP, tomorrow (Leg 2) the counterparty gets its greenbacks dorsum with a bit of interest.

Because this is a risk-costless investment option, the given institutions will likely never be willing to lend funds for lower than the ON RRP rate. As such, the ON RRP rate acts every bit a reservation rate and institutions can use it to arbitrage other brusque-term rates. Thus, the charge per unit paid on ON RRP transactions, which is gear up below the IORB rate, acts like a floor for the FFR and serves equally a supplementary policy tool.

Table three provides a summary of the tools used in an aplenty-reserves framework. These concepts should exist covered in textbooks and curricula. In fact, the IORB and ON RRP rates should be the focus of policy implementation discussions, with open up market operations mentioned as a maintenance tool. This discussion has quite a different focus from that in the limited-reserves framework.

During recent times of severe stress, the ample-reserves framework has connected to support the implementation of monetary policy. The Fed'due south response to the COVID-19 pandemic has been similar to its response to the Financial Crisis of 2007-09. With the ultimate goal of stimulating the economic system, it has lowered the FFR target range to 0 to 25 basis points; lowered the IORB and ON RRP rates to virtually zero; and taken other, oft unconventional, actions to help markets function, support credit flows to households and businesses, and lower longer-term interest rates.16 The majority of the Fed'southward special facilities enabled information technology to purchase, lend, or bandy less-liquid financial assets in return for reserves. Now, as during the Financial Crisis of 2007-09, these actions have shifted the supply bend in Effigy 3 to the correct and resulted in reserves becoming quite abundant. Though these actions were quite quick and substantial, implementation of monetary policy remained shine equally the Fed connected to operate in its existing (ample-reserves) implementation framework.

Comparison the Aplenty-Reserves Framework with the Limited-Reserves Framework

The archetype model for teaching monetary policy in the classroom features a money supply and demand model. A key difference between the limited-reserves framework and the ample-reserves framework lies in where the supply curve intersects the demand curve.

- In the limited-reserves framework (Panel A of Effigy 6), the supply curve intersects the demand bend on the downward sloping part of the need curve. In this region, relatively small shifts of the supply bend to the right (left) move the FFR rate lower (higher).

- In the ample-reserves framework (Console B of Figure vi), the supply curve intersects the demand curve on the apartment portion of the need curve. In this region, relatively pocket-size shifts of the supply bend take piddling or no upshot on the FFR rate.

Based on the supply of reserves, the Fed uses different primary tools to steer interest rates into the desired range.

- The express-reserves framework (see Console A of Effigy 6) leans on the Federal Reserve'southward use of open up market operations to make adjustments to the supply of reserves to ensure the market FFR is at the FOMC'southward FFR target. This tool'due south event on the FFR requires students to understand the abstruse topic of how open marketplace operations work and then link this action back to the need-supply diagram.

- The ample-reserves framework (see Console B of Figure 6) relies on the Federal Reserve'southward administered rates—in item the IORB rate—to influence the FFR. The linkage between the Fed's tools and the FFR requires an agreement of how banks can arbitrage across investment options.

Explaining the implementation of monetary policy is often a focus of textbooks, standards, and curricula. Discussion of the monetary policies tools used, then, needs to differ co-ordinate to the policy framework. For example, say the FOMC has lowered the target for the FFR rate. How does the Fed ensure that this lower target is transmitted to financial markets? Let'south consider the key tools used in each framework.17

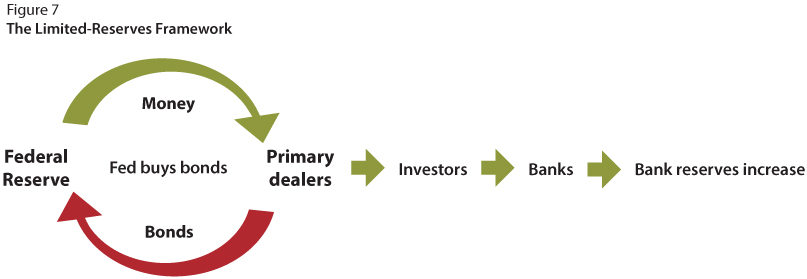

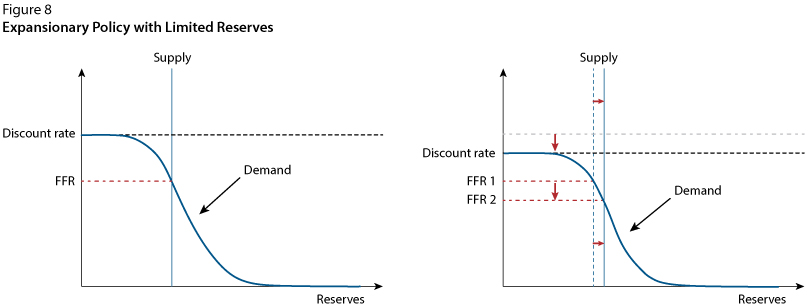

To implement expansionary policy in the pre-2008 limited-reserves framework, the New York Fed'south Open Marketplace Trading Desk-bound used open market operations: Information technology bought government securities from chief dealers to increase the level of reserves in the cyberbanking organization. The increased supply of reserves resulted in a lower FFR (see Figure 8).

In the limited-reserves framework, the Fed would buy securities in the open marketplace to influence the FFR rate to motion toward the new lower target. More specifically, every bit shown in Figure 7, the New York Fed'due south Open up Market Trading Desk would utilise open market operations: It would buy government securities from its primary dealers, who sell these securities on behalf of their clients (investors). The coin received from the sales would then be deposited in banks, resulting in an increase in the level of reserves in the cyberbanking system. The increase in the level of reserves (a rightward shift of the supply curve) would result in a decrease in the FFR, as shown in Figure 8.

In the limited-reserves framework, when the Federal Reserve used open market operations to increment the level of reserves in the banking system, the vertical supply curve would shift to the correct, and the new intersection of the supply and demand curves would result in a lower FFR. The Fed also tended to lower the discount charge per unit to proceed the spread between the discount rate and the FFR target abiding.

In an ample-reserves framework, the Fed would lower its administered rates, in particular the IORB rate. This action would lower the reservation rate for reserves, putting downwardly pressure level on the FFR.

In an aplenty-reserves framework, when the Federal Reserve lowers its administered rates, the terminate points of the demand curve shift down. The vertical supply curve is unchanged. The demand curve intersects the supply curve at a lower FFR rate. In general, the Fed tends to lower all the administered rates by the same amount, keeping the spread betwixt the rates constant.

Graphically, in the ample-reserves framework, as the Fed lowers its administered rates (including the disbelieve rate) the endpoints of the need curve shift down, every bit shown in Figure 9. The lower discount rate pushes downwards the pinnacle of the demand curve. The discount rate acts equally a ceiling for the FFR because banks (bated from the perceived stigma) would exist unlikely to borrow funds at a college charge per unit than they could borrow from the Fed at the discount window. The lesser of the demand curve shifts down to reflect the Fed's lower reservation rates (the IORB and ON RRP rates) for depositing excess cash. This lower demand curve then intersects with the supply curve at a lower FFR.

Finally, ane can meet a difference in what each framework can do when the Fed is confronted with severe economic strains and needs to innovate unconventional tools. The use of large-scale asset purchases or emergency credit programs are needed during these times and outcome in very large increases in reserves in the banking system. Only one of the 2 frameworks would be able to implement such policies:

- A limited-reserves framework would no longer be functional. Equally we saw during the Financial Crunch of 2007-09, reserves became super abundant and the Fed had to shift to operating in an ample-reserves framework, using IORB equally the primal tool.

- An aplenty-reserves framework would continue to work as expected, equally we saw with the onset of the COVID-19 pandemic.

Summary

The way the Fed implements monetary policy has changed. It is important for teachers and professors to sympathize the electric current framework so they are teaching their students accurately. This document has contrasted the old and new frameworks to support instructors in that endeavor.

Notes

1 Powell, Jerome. "Information-Dependent Monetary Policy in an Evolving Economy." Board of Governors of the Federal Reserve Arrangement, October 8, 2019; https://www.federalreserve.gov/newsevents/speech/powell20191008a.htm, accessed July 1, 2020.

2 In 1977, Congress amended the Federal Reserve Deed, directing the Board of Governors of the Federal Reserve Organization and the Federal Open Marketplace Committee to "maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, then as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates."

iii Lath of Governors of the Federal Reserve System. "Monetary Policy Report – July 2018." https://www.federalreserve.gov/monetarypolicy/2018-07-mpr-part2.htm.

4 On any given day, at that place are many transactions that settle at slightly different FFRs. The effective FFR is the volume-weighted median rate of these transactions. The constructive FFR is the rate nosotros use in the figures in this article.

5 Many textbooks link the money supply to interest rates. The inclusion of that link dates back to the 1970s and 1980s, when measures of the money supply exhibited fairly close relationships with important economic variables such every bit nominal gross domestic product and the cost level. Based partly on these relationships, the Fed conducted monetary policy past targeting growth rates of diverse measures of money. Since the mid-1990s, however, these relationships take been quite unstable. As a outcome, the importance of the money supply equally a guide for the FOMC in its conduct of budgetary policy has macerated and the Fed has shifted to targeting the level of the FFR, which is directly influenced past the supply of reserves in the banking arrangement.

6 The term "open market" refers to the fact that the Fed doesn't buy securities directly from the U.S. Treasury. Instead, securities dealers compete in the open up market place based on cost, submitting bids or offers to the Open Market Trading Desk of the Federal Reserve Bank of New York through an electronic sale organization.

7 The Fed likewise implemented a number of credit and liquidity programs early on in the Fiscal Crisis to support financial institutions and foster improved conditions in financial markets. These special programs expired or were closed after some time.

8 For a description of the Fed's big-scale nugget purchases, see Board of Governors of the Federal Reserve Organisation. "What Were the Federal Reserve'south Large-Scale Asset Purchases?" FAQs; https://www.federalreserve.gov/faqs/what-were-the-federal-reserves-large-scale-asset-purchases.htm.

9 This decision reflects the fact the Federal Reserve shifted to an ample-reserves framework, and reserve requirements are non necessarily a tool in this framework.

10 See Board of Governors of the Federal Reserve System. "Argument Regarding Budgetary Policy Implementation and Balance Sheet Normalization." Printing release, January 30, 2019; https://www.federalreserve.gov/newsevents/pressreleases/monetary20190130c.htm.

11 More recently, in response to the COVID-xix pandemic, reserves accept grown substantially. By April 2020, reserves expanded and stood above $iii trillion, at a college level than their peak during the aftermath of the Great Recession.

12 Board of Governors of the Federal Reserve System. "Interest on Required Reserve Balances and Excess Balances." https://www.federalreserve.gov/monetarypolicy/reqresbalances.htm, accessed June 10, 2020.

13 Lath of Governors of the Federal Reserve System. "Overnight Contrary Repurchase Agreement Facility." https://world wide web.federalreserve.gov/monetarypolicy/overnight-reverse-repurchase-agreements.htm; accessed June 4, 2020.

14 Federal Reserve Bank of New York. "Contrary Repo Counterparties." https://www.newyorkfed.org/markets/rrp_counterparties; accessed June 10, 2020.

15 Board of Governors of the Federal Reserve Arrangement. "Overnight Contrary Repurchase Agreement Facility." https://www.federalreserve.gov/monetarypolicy/overnight-contrary-repurchase-agreements.htm; accessed June iv, 2020.

16 A complete list of policy tools can exist institute at the Board of Governors of the Federal Reserve Arrangement website: https://www.federalreserve.gov/monetarypolicy/policytools.htm.

17 In nearly instances, the disbelieve rate would be lowered (in each framework) to go on the spread between the discount rate and the FFR constant.

Additional Resources

Ihrig, Jane; Senyuz, Zeynep and Weinbach, Gretchen. "The Fed'due south 'Ample Reserves' Approach to Implementing Monetary Policy." Lath of Governors of the Federal Reserve Arrangement, 2020; https://www.federalreserve.gov/econres/feds/the-feds-aplenty-reserves-approach-to-implementing-monetary-policy.htm.

Ihrig, Jane and Wolla, Scott. "Fixing the 'Curriculum Lag' in Economics: The New Tools the Fed is Using to Influence the Economy." National Council for the Social Studies Social Education, 2020, 84(2), pp. 93-99.

Wolla, Scott. "A New Borderland: Monetary Policy with Ample Reserves." Federal Reserve Depository financial institution of St. Louis Folio I Economics ®, May 2019; https://research.stlouisfed.org/publications/page1-econ/2019/05/03/a-new-frontier-monetary-policy-with-ample-reserves.

Wolla, Scott. "Fixing the 'Textbook Lag' with FRED (Function I): Monetary Policy in a World of Ample Reserves." Federal Reserve Bank of St. Louis FRED ® Blog, June 10, 2019. https://fredblog.stlouisfed.org/2019/06/fixing-the-textbook-lag-with-fred-function-i/.

Wolla, Scott. "Fixing the 'Textbook Lag' with FRED (Function II): Monetary Policy in a Earth of Aplenty Reserves." Federal Reserve Bank of St. Louis FRED® Blog, June 13, 2019; https://fredblog.stlouisfed.org/2019/06/fixing-the-textbook-lag-with-fred-part-two/.

© 2020, Federal Reserve Bank of St. Louis. The views expressed are those of the writer(south) and do not necessarily reverberate official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Which Of The Following Is The Most Frequently Used Tool The Fed Uses To Control The Supply Of Money?,

Source: https://research.stlouisfed.org/publications/page1-econ/2020/08/03/the-feds-new-monetary-policy-tools

Posted by: adamsbareiteraw.blogspot.com

0 Response to "Which Of The Following Is The Most Frequently Used Tool The Fed Uses To Control The Supply Of Money?"

Post a Comment